What: Ivan Barona Gonzalez, Head of Business Intelligence at Grupo Bursátil Mexicano, gave Portada Mexico a birds eye view of Mexicos consumer finance and banking landscape.

Why it matters: Barona explains why GBM has chosen education and attraction over pure product promotion to attract new customers in the face of Mexicos low rate of consumer use of banking and financial services.

Mexicos unbanked population poses both challenges and opportunities to banks and financial services companies looking for new customers.

According to Ivan Barona Gonzalez, Head of Business Intelligence at Grupo Bursátil Mexicano, roughly 76 million Mexicans—about forty-percent of adults between the ages of 18 and 70—dont have a bank account. Forty-six percent do not have access to formal credit and fifty-two percent dont have formal retirement accounts.

The challenge for GBM is how to turn this landscape of the unbanked into a land of opportunity for financial services.

“We try to educate people,” Barona told participants at last months Portada México in Mexico City. “Given the needs of the Mexican market, we consider that financial education plays an important opportunity.”

“People should, first and foremost know that they have choices, and then make the best choices according to their needs.”

GBM is an investment bank with more than 35 years of experience and is currently the largest in Mexico as measured by traded volume on the Mexican stock exchange.

GBMs parent owner, Corporativo GBM, operates subsidiaries in México, Brazil, Chile and the U.S. Three decades of experience in the Mexican market have made GBM an authoritative brand in Mexicos investment industry.

The story is not about us, it is about what you can become with our services and products.

But the focus of GBMs marketing isnt on its reputation. Instead, the focus is on how customers can benefit from its products and services.

“The story is not about us, it is about what you can become with our services and products,” Barona told Portada Mexico.

Focus on the consumer

According to Barona, GBM marketing is focused on markets (whats happening), knowledge (what should I know or learn?) and lifestyle (why is it important for me, what can I do with this?).

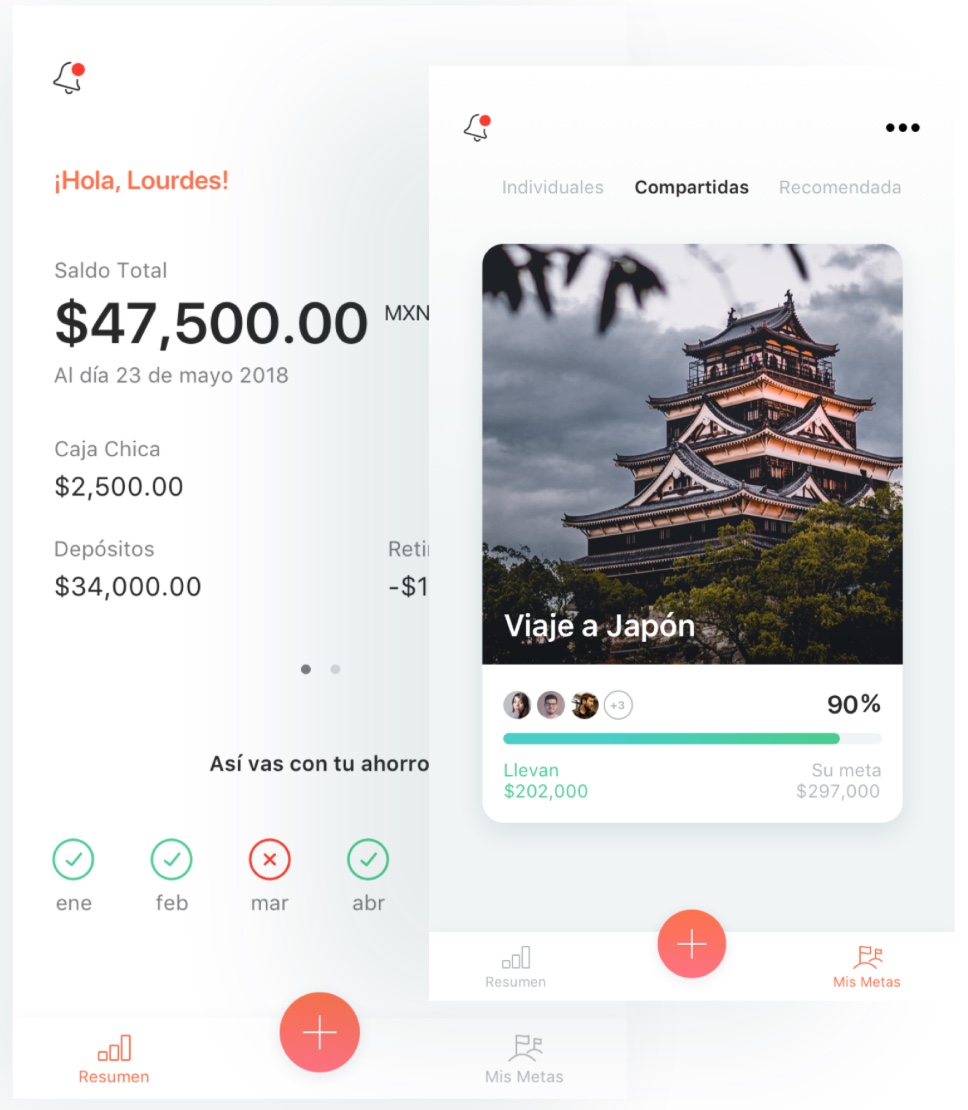

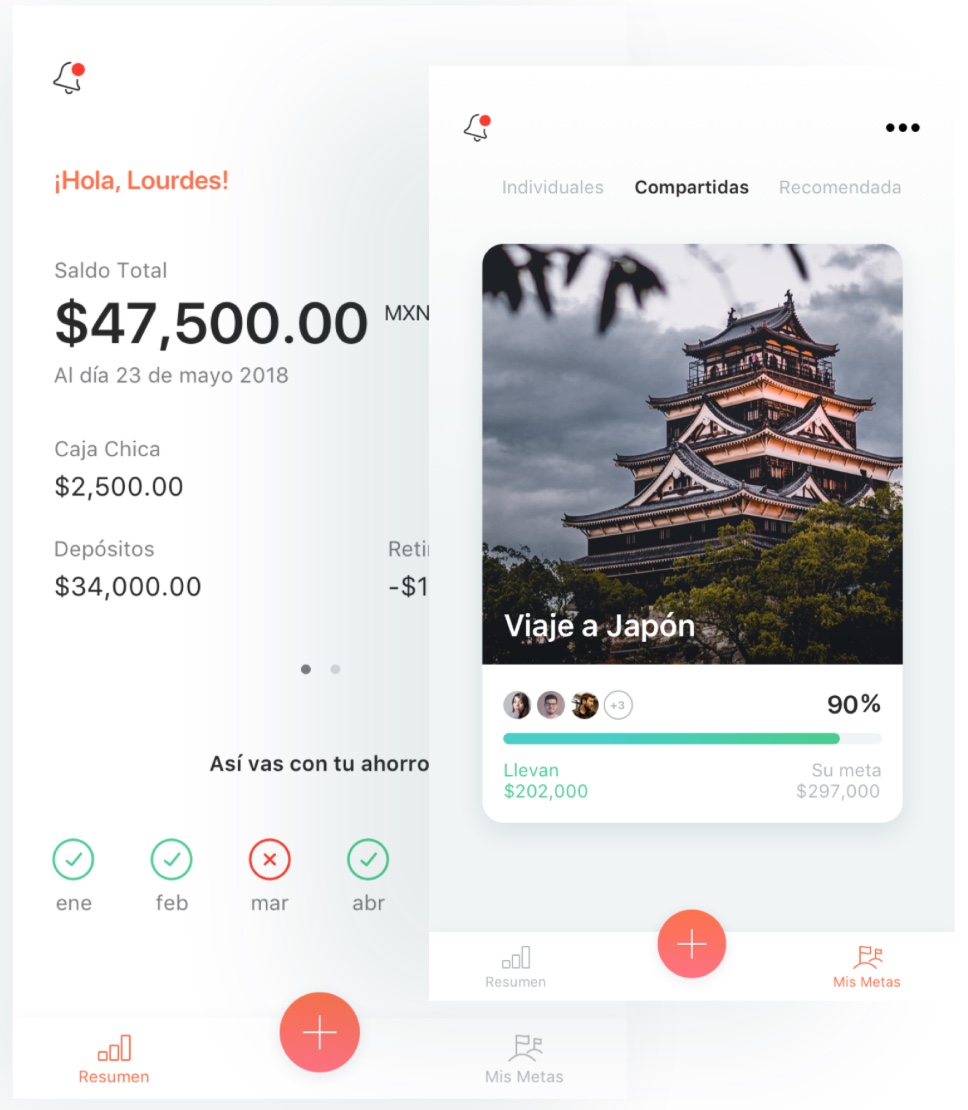

One example is GBMs recent “Piggo” campaign.

The Piggo website offers consumers a downloadable app they can use to plan savings for a trip to Europe, a new car or any other important goal.

The app helps users to define their goals and the money they would like to save to reach them, and then creates a schedule of savings through automatic deposits so users can “save without realizing it.”

A Piggo challenge encouraged users to post pictures of their travel experiences on social media.

“We identified that money can be considered as primitive…but it gives you the freedom to connect with your hopes, wishes, and goals,” Barona explained.

We identified that money can be considered as primitive…but it gives you the freedom to connect with your hopes, wishes, and goals.

The campaign isnt as much about selling a product as it is about how people can succeed in savings,” Barona told Portada Mexico.

“The campaign was addressed for a demographic that was eager to travel the world, and aimed for empathy and virality.”

For an opportunity to participate in thought-provoking panels and a chance to network with the leading brand marketers in Latin America, join Portada Mexico 2019 here.

Big potential

In a question and answer session following his presentation, Barona emphasized the potential GBM sees in the vast numbers of Mexicans who dont have savings, investment or retirement accounts.

Two-thirds of Mexicans do save, but through informal means. While in the US, six out of every 10 Americans invest in the stock market, in Mexico the ratio is 1 to 500.

Meanwhile, advances in technology have lowered the cost of extending existing financial infrastructure to serve new customers.

“Technology is usually capital expensive on the early stages, however, once you reach a specific size, and surpass the breakeven, you can get new customers on a marginal or even negligible cost, thus, achieving exponential returns,” Barona told Portada.

“We are aware of the potential in the market,” he said.

Mark A. Browne

Mark A. Browne is Portada's Marketing Innovation Editor. He is a bilingual (English-Spanish) writer, media relations manager, and content creation professional with an established record providing journalism, copywriting and analytical content services to major publishers, PR agencies and businesses in the United States, Latin America and Europe. His award-winning career as a reporter and editor includes daily and weekly newspaper experience and free-lance writing for major print and online publications.

What: Ivan Barona Gonzalez, Head of Business Intelligence at Grupo Bursátil Mexicano, gave Portada Mexico a birds eye view of Mexicos consumer finance and banking landscape.

Why it matters: Barona explains why GBM has chosen education and attraction over pure product promotion to attract new customers in the face of Mexicos low rate of consumer use of banking and financial services.

Mexicos unbanked population poses both challenges and opportunities to banks and financial services companies looking for new customers.

According to Ivan Barona Gonzalez, Head of Business Intelligence at Grupo Bursátil Mexicano, roughly 76 million Mexicans—about forty-percent of adults between the ages of 18 and 70—dont have a bank account. Forty-six percent do not have access to formal credit and fifty-two percent dont have formal retirement accounts.

The challenge for GBM is how to turn this landscape of the unbanked into a land of opportunity for financial services.

“We try to educate people,” Barona told participants at last months Portada México in Mexico City. “Given the needs of the Mexican market, we consider that financial education plays an important opportunity.”

“People should, first and foremost know that they have choices, and then make the best choices according to their needs.”

GBM is an investment bank with more than 35 years of experience and is currently the largest in Mexico as measured by traded volume on the Mexican stock exchange.

GBMs parent owner, Corporativo GBM, operates subsidiaries in México, Brazil, Chile and the U.S. Three decades of experience in the Mexican market have made GBM an authoritative brand in Mexicos investment industry.

The story is not about us, it is about what you can become with our services and products.

But the focus of GBMs marketing isnt on its reputation. Instead, the focus is on how customers can benefit from its products and services.

“The story is not about us, it is about what you can become with our services and products,” Barona told Portada Mexico.

Focus on the consumer

According to Barona, GBM marketing is focused on markets (whats happening), knowledge (what should I know or learn?) and lifestyle (why is it important for me, what can I do with this?).

One example is GBMs recent “Piggo” campaign.

The Piggo website offers consumers a downloadable app they can use to plan savings for a trip to Europe, a new car or any other important goal.

The app helps users to define their goals and the money they would like to save to reach them, and then creates a schedule of savings through automatic deposits so users can “save without realizing it.”

A Piggo challenge encouraged users to post pictures of their travel experiences on social media.

“We identified that money can be considered as primitive…but it gives you the freedom to connect with your hopes, wishes, and goals,” Barona explained.

We identified that money can be considered as primitive…but it gives you the freedom to connect with your hopes, wishes, and goals.

The campaign isnt as much about selling a product as it is about how people can succeed in savings,” Barona told Portada Mexico.

“The campaign was addressed for a demographic that was eager to travel the world, and aimed for empathy and virality.”

For an opportunity to participate in thought-provoking panels and a chance to network with the leading brand marketers in Latin America, join Portada Mexico 2019 here.

Big potential

In a question and answer session following his presentation, Barona emphasized the potential GBM sees in the vast numbers of Mexicans who dont have savings, investment or retirement accounts.

Two-thirds of Mexicans do save, but through informal means. While in the US, six out of every 10 Americans invest in the stock market, in Mexico the ratio is 1 to 500.

Meanwhile, advances in technology have lowered the cost of extending existing financial infrastructure to serve new customers.

“Technology is usually capital expensive on the early stages, however, once you reach a specific size, and surpass the breakeven, you can get new customers on a marginal or even negligible cost, thus, achieving exponential returns,” Barona told Portada.

“We are aware of the potential in the market,” he said.

Mark A. Browne

Mark A. Browne is Portada's Marketing Innovation Editor. He is a bilingual (English-Spanish) writer, media relations manager, and content creation professional with an established record providing journalism, copywriting and analytical content services to major publishers, PR agencies and businesses in the United States, Latin America and Europe. His award-winning career as a reporter and editor includes daily and weekly newspaper experience and free-lance writing for major print and online publications.